For several decades, credit has been seen as a scary topic. Consumers spread the word and there has become a fear of credit so consumers don’t review their report. This is all due to the fact that creditors and bureaus have made it challenging to do so.

With the consumer in mind, the redesigned credit report invites consumers with a better understanding of what they are looking at even if they are not credit savvy. This is the end of the fear of credit and there’s numbers to back it.

My Role

- Design Team Lead

- Research

- User Testing

- User Experience

- Prototyping

- Outsource Management

Team

- 1 Designer

- 1 Researcher

- 1 Content Strategist

- Outside Research Agency

01. Task At Hand

Experian Consumer Information Services has driven an industry-leading 99.8% data accuracy rate. but due to credit repair organizations, the rise of frivolous dispute volume and cost to millions of consumers and credit bureaus. The execution plan was to reduce volume by at least 35% and cost by at least 40%.

02. Goals

- Gain insight into the consumer content priorities on the credit report

- Determine preferred layout and organization of content.

- Identify current pain points with the credit report experience.

- Identify opportunities to improve the credit report experience.

03. Ideation

Working with an outside agency, we performed one-on-one interviews for 1 hour and 30 minutes for a total of 4 days interviewing 12 consumers ranging from 24-65 of age. All consumers have experience disputing items on their credit report. We then spent a full day (8 hours) in a room reviewing and organizing the data with post-its in a room.

Reducing Data-driven Disputes

Demographic Data Initiatives

(address, name, SSN, employer, phone number)

Intracycle Processing

(meaningful, event-based changes during the month)

Unnecessary Duplication

(sold portfolios, transfers to collections, duplicate charge-offs, unverifiable accounts)

Non-Consequential Disputes

(estimated incremental impact from CDI and other touchpoint changes)

Frivolous Disputes From CROs

(identification and standards to reduce high-levels of accurate data disputing)

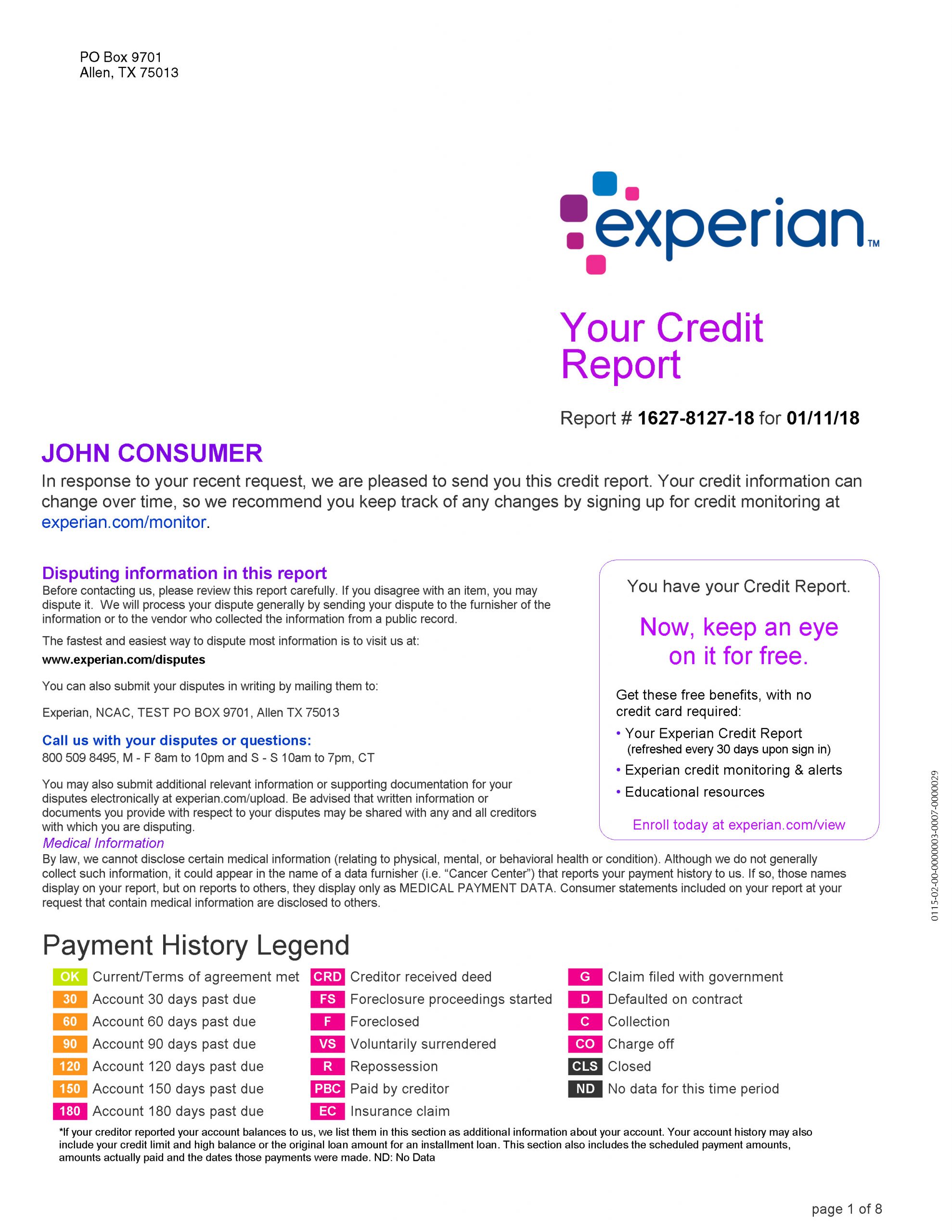

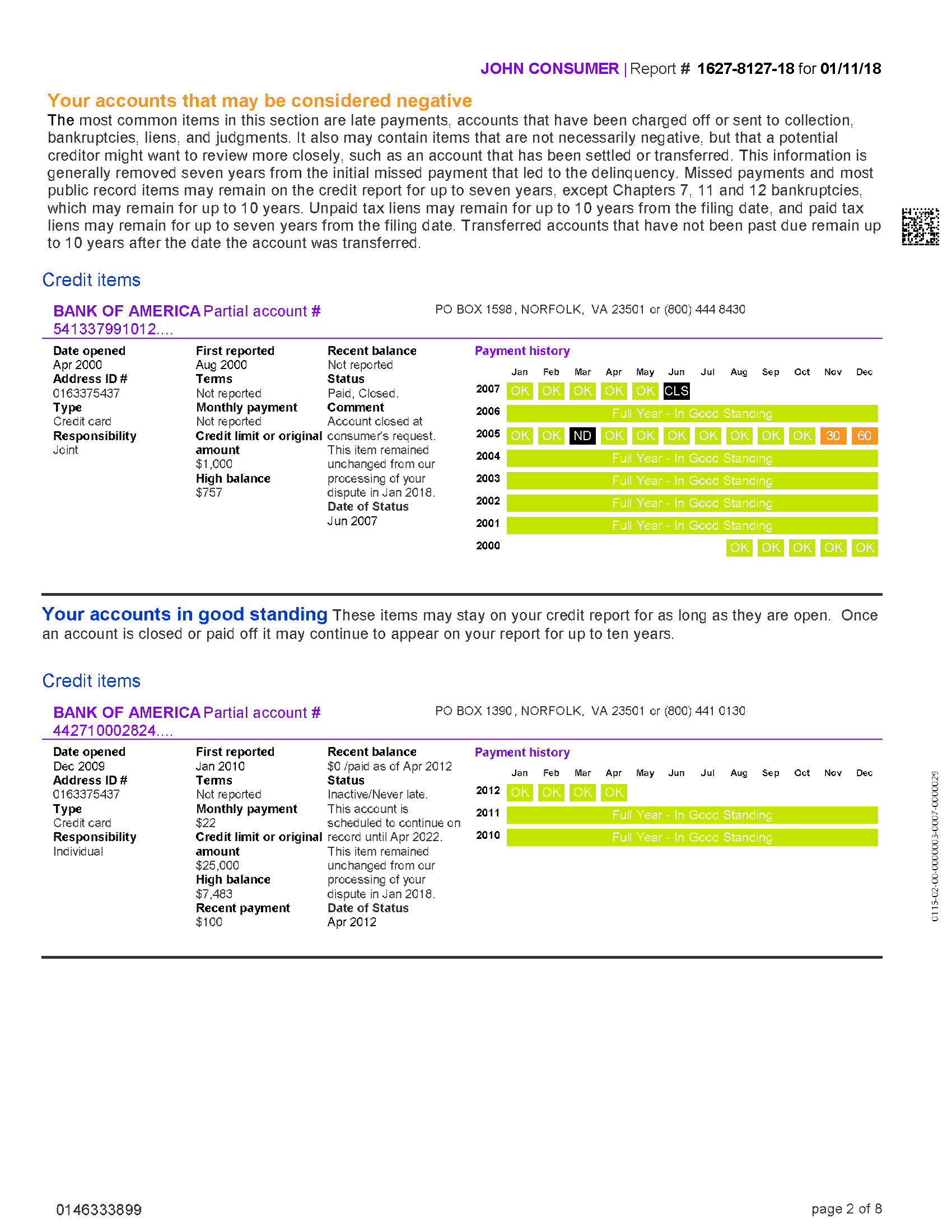

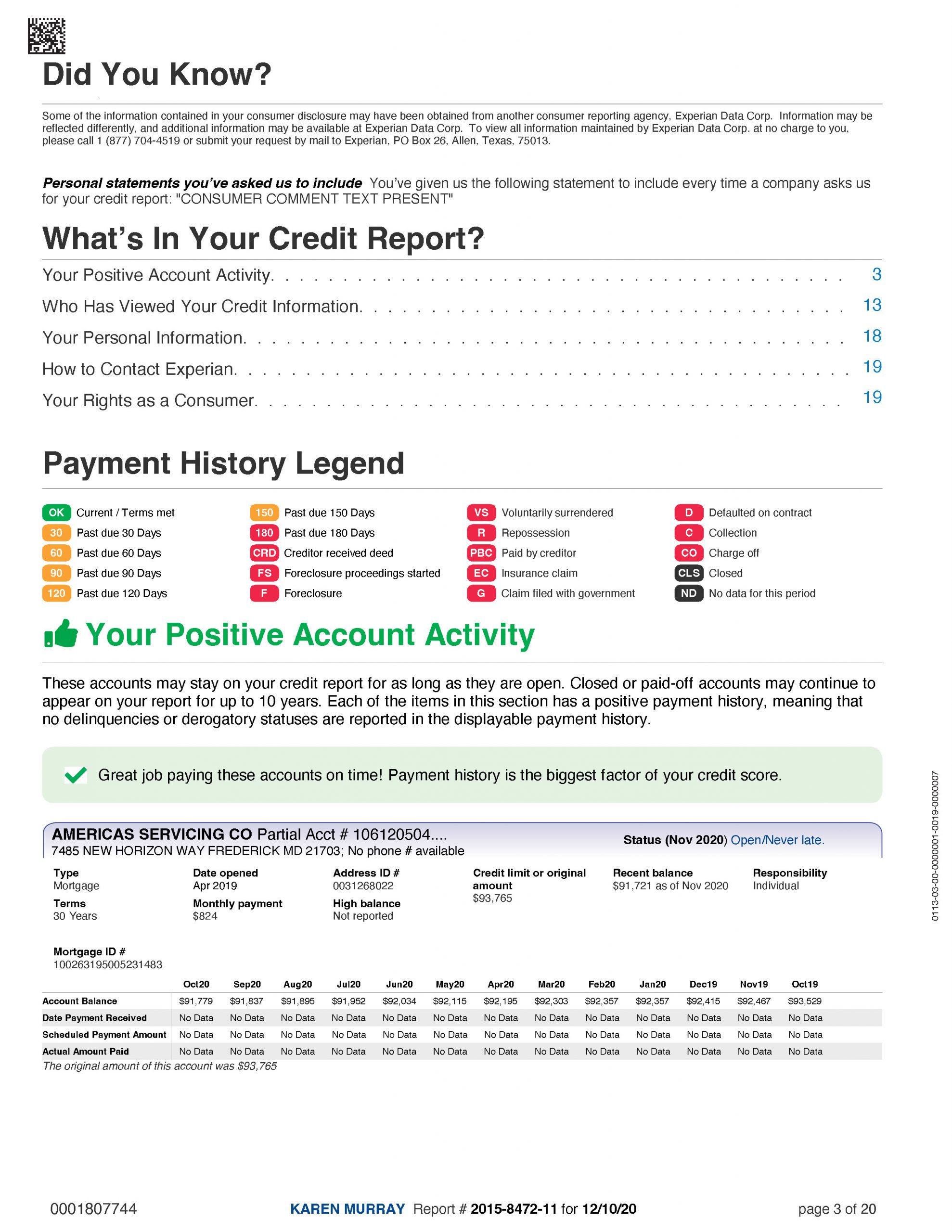

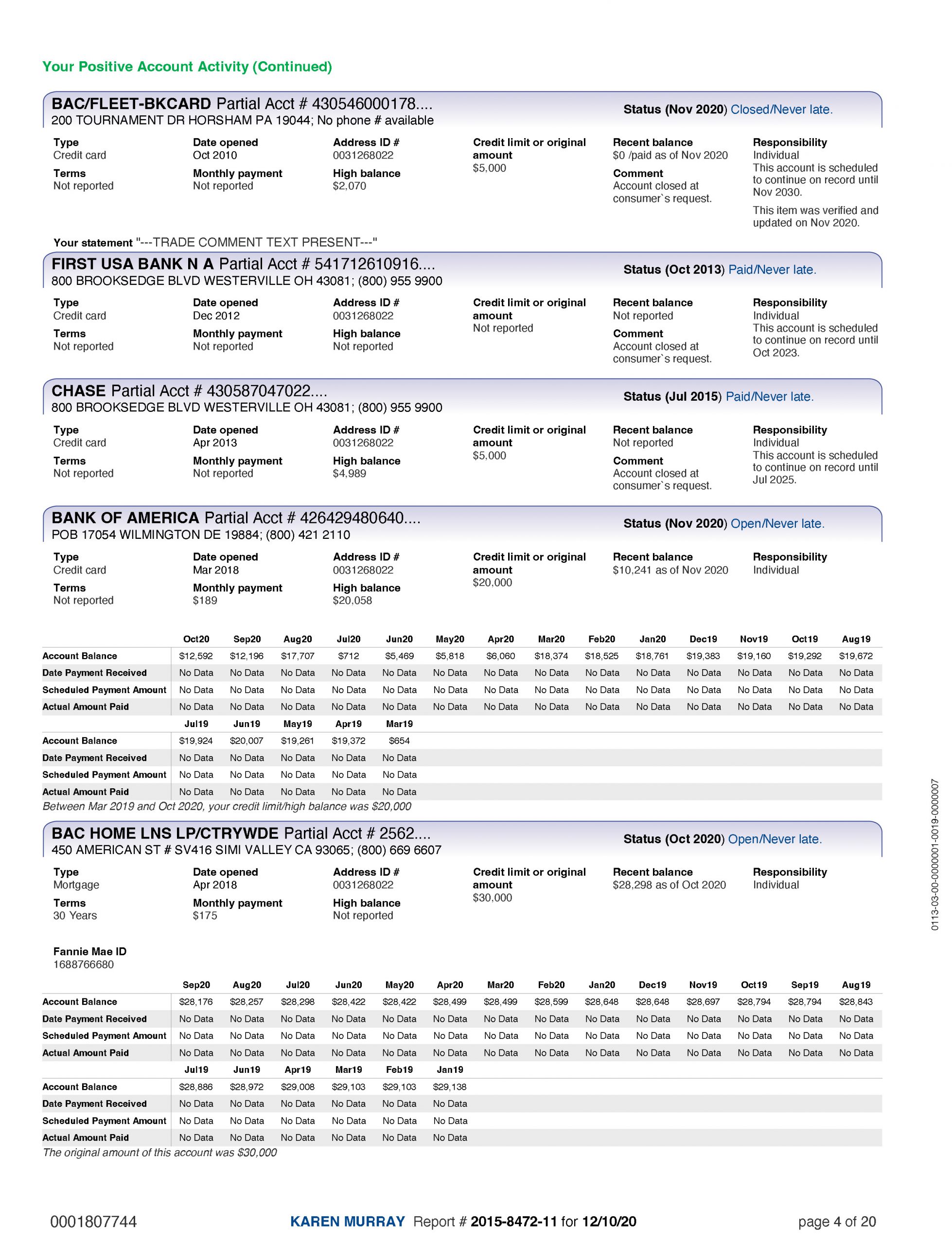

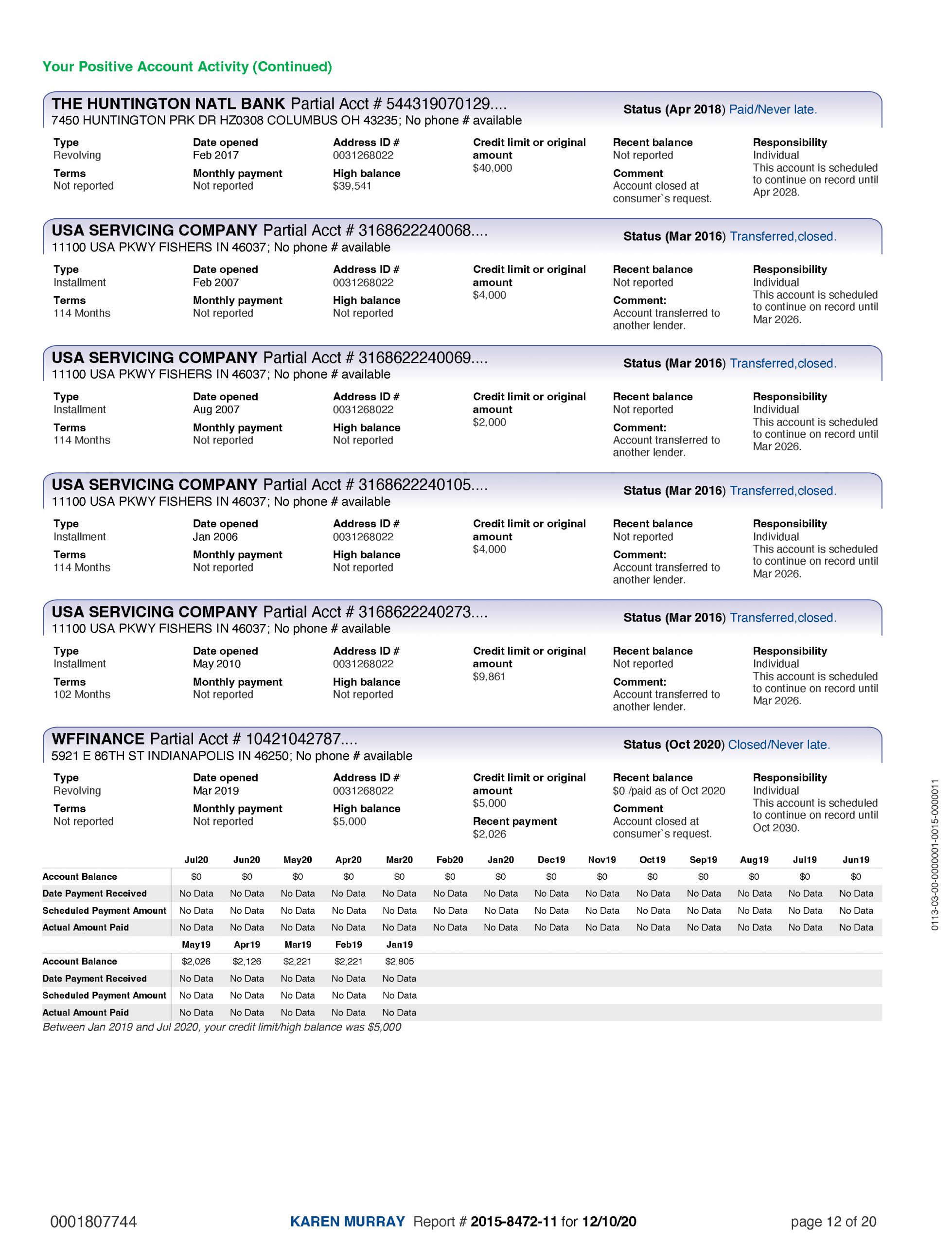

Consumer Credit Report Before Exploration

We spent the first 30 minutes interviewing the consumers to understand their credit history, goals and general experience including what their credit report dispute experiences we like. We dove into reviewing the current Experian credit report.

Top 5 Findings

I expect to see my credit score

I want to understand the underlying factors behind my score

Tell me how to improve my credit

Impactful information is my focus

Meet my expectations

Layout Preferences

In our participatory sessions, participants communicated their preferences for content prioritization and organization. We synthesized and analyzed the findings and identified trends and patterns.

During our “Build your own credit report” exercise, participants created a credit report that reflects the content and organization of information they ideally want to see.

Overview

On the main page, participants expect to view:

- “At-a-glance” overview of the report

- Credit score

- Ways to improve their credit

- Guidance and tips

Personal Info & Credit Score

- Majority of participants want current personal information on the main page.

- All participants (except one) want their credit score on the main page.

Summary & Credit Score Factors

- Participants want to see a summary of their credit report with a focus on what they need to do to improve their credit.

- There was a lack of consistency regarding the location of ‘Dispute Results’.

As participants are skimming and scanning this report, they want to quickly focus on the accounts that are negatively impacting their credit.

Overview

Participants expect:

- Account summaries to glean a quick overview

- Accounts organized intuitively to them so they are easy to scan and digest

- Account information presented simply and concisely

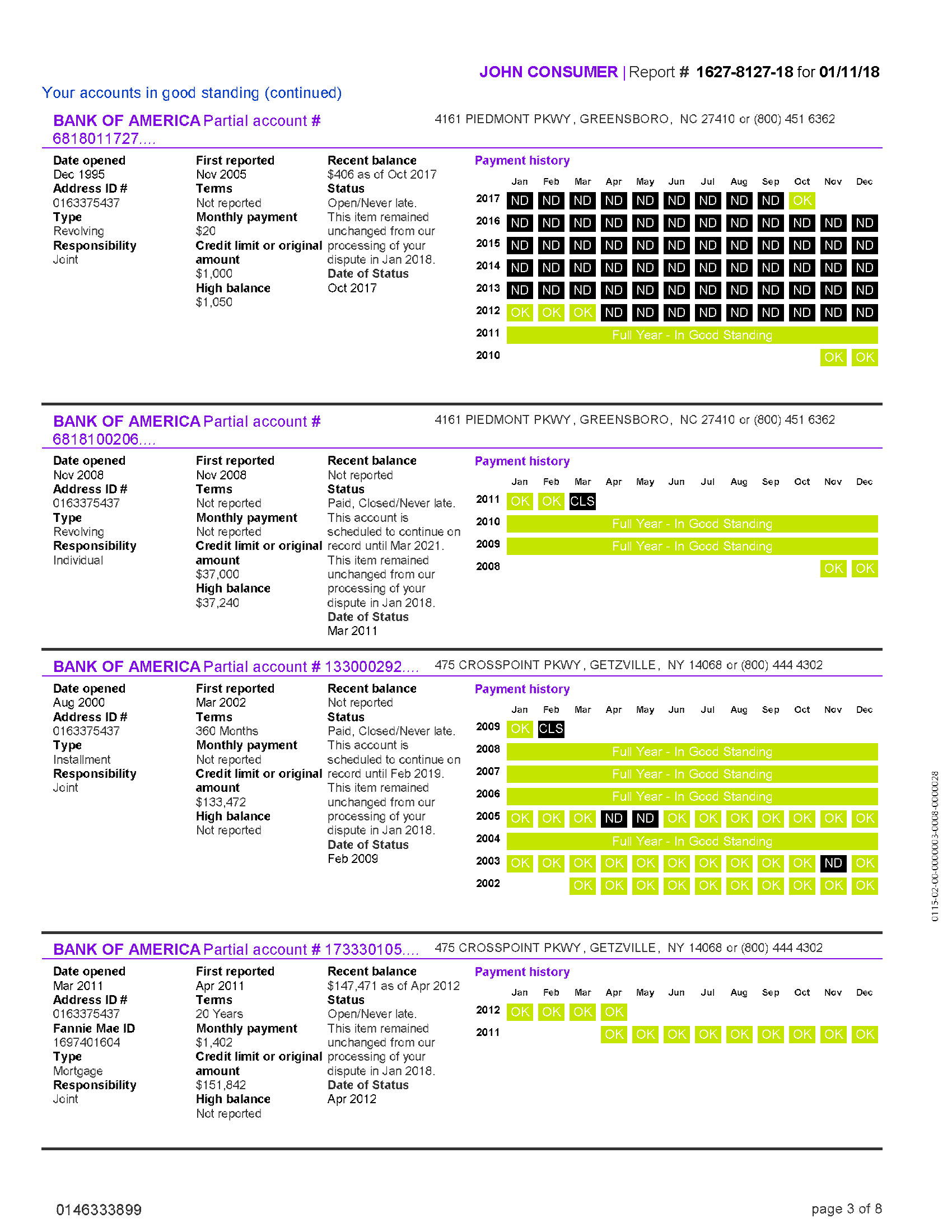

Organize Accounts By Poor And Good Standing

- Majority of participants want an account overview before delving into details.

- Majority of participants want accounts divided between good accounts and poor accounts

- Majority of participants want to see accounts grouped by opened and closed accounts. Within these, they want accounts grouped by type.

Give Details For Accounts In Poor Standing

- Participants want all the details of their accounts in poor standing.

- Several participants requested minimal information on good standing accounts, especially those that are closed.

- Participants want the payment history legend to be in close proximity to related charts.

Accounts Should Be Organized By Credit Impact

- Within types, participants want accounts ranked from highest impact to lowest impact. They want to recognize this at a glance.

- Participants want to be educated on what factors impact their credit.

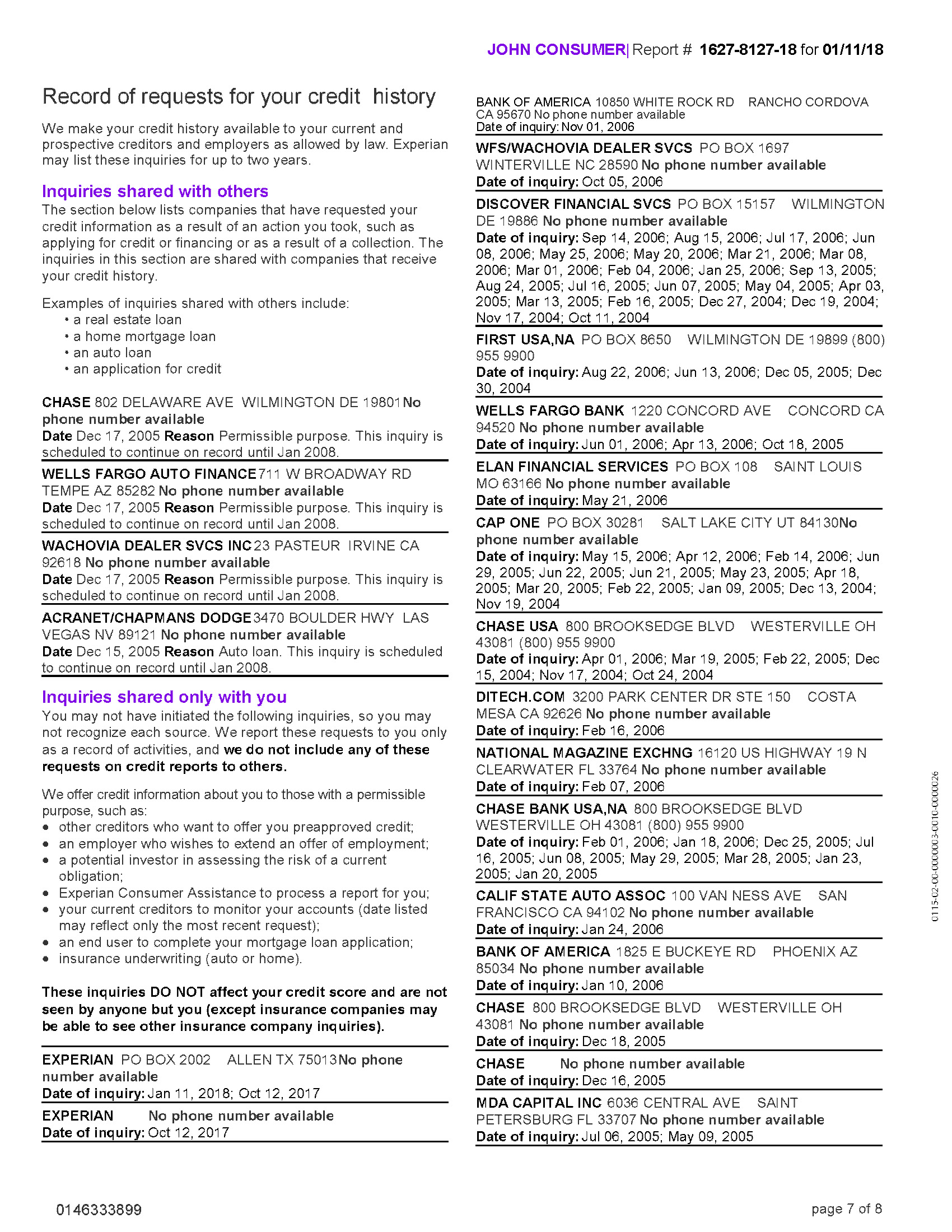

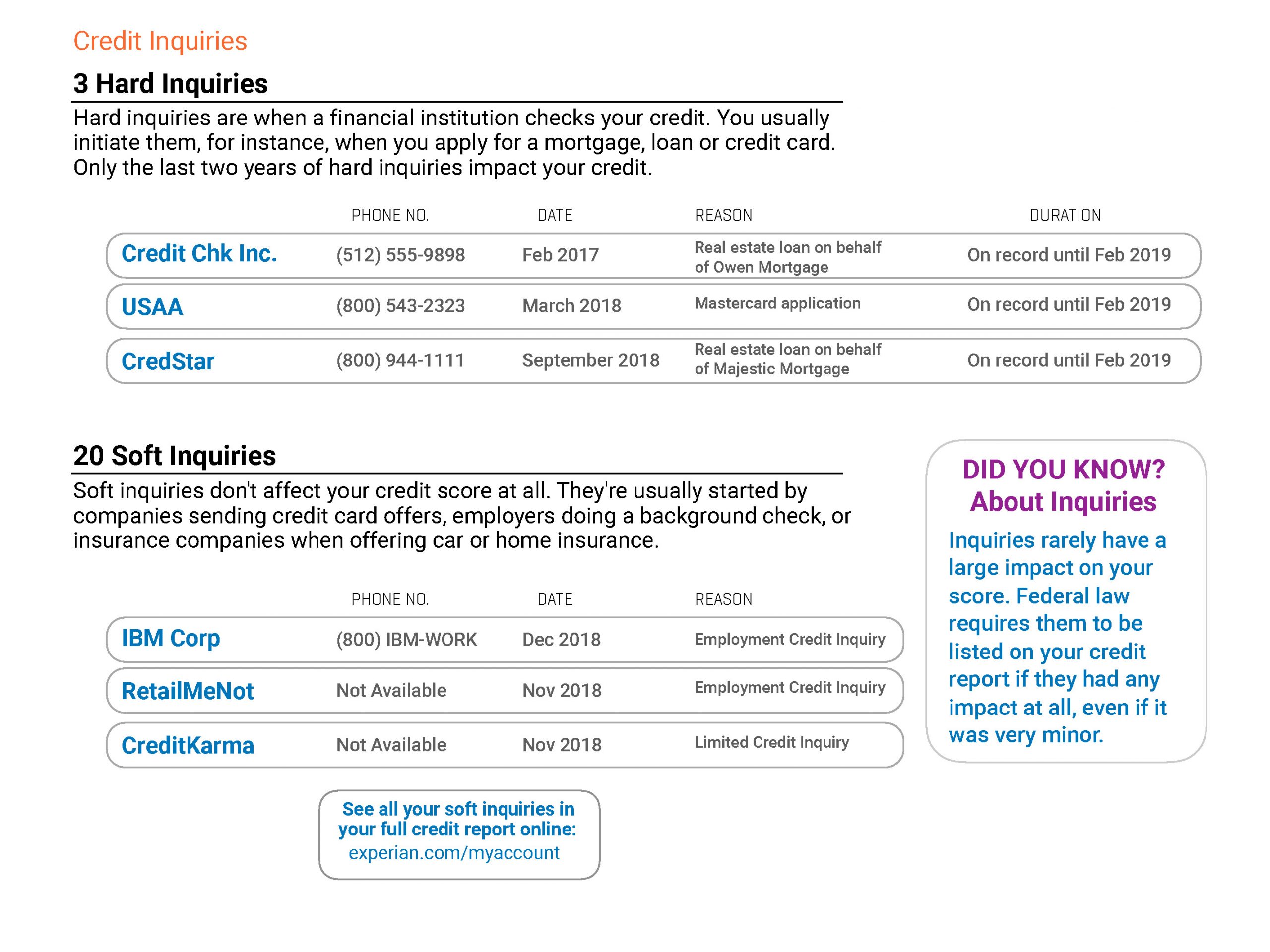

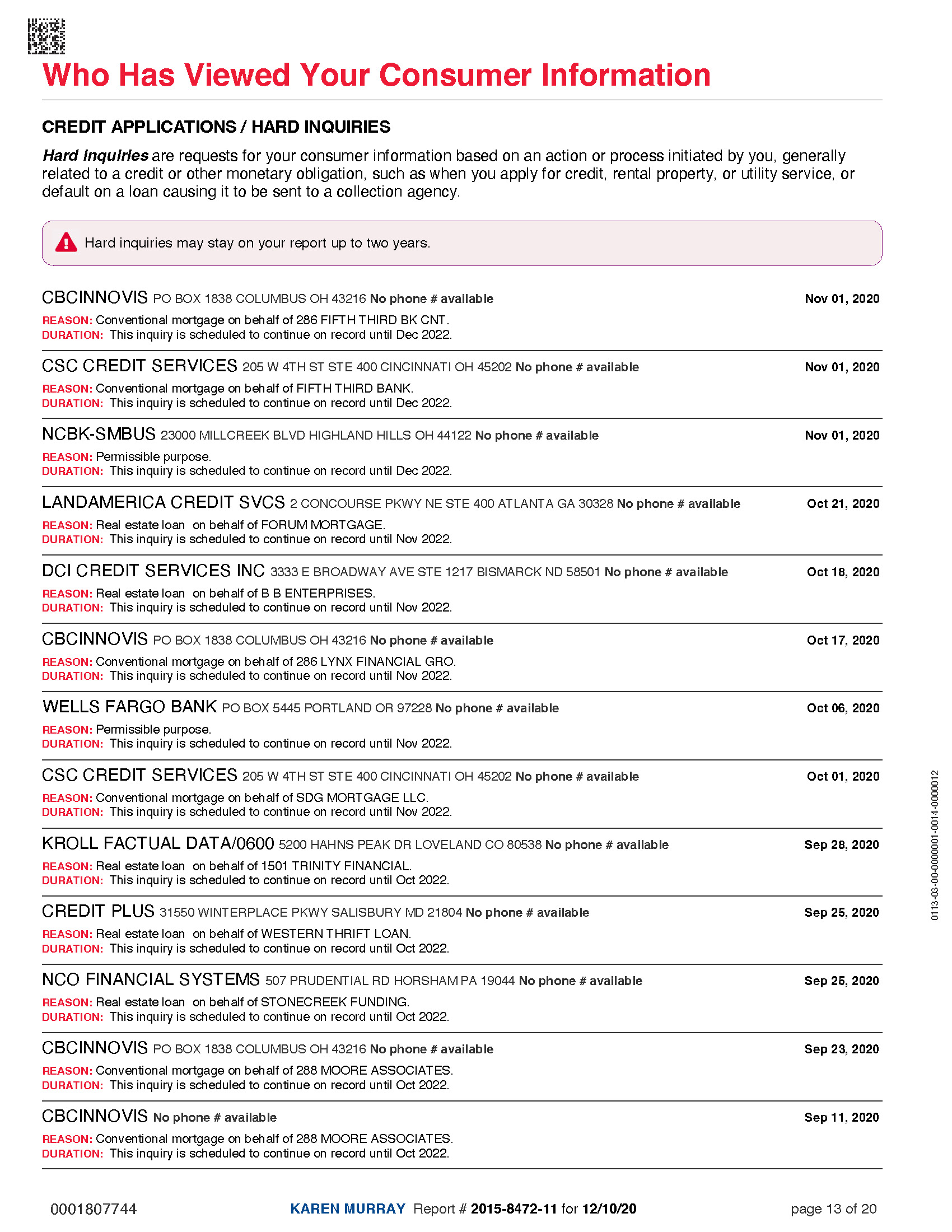

Participants want the report to focus on the inquiries that have an impact on their credit. They want to be informed as to what that impact is.

Overview

Regarding inquiries, participants primarily care about:

- Only impactful credit inquiries (last two years of hard inquiries)

Limit Credit Inquiries To The Bare Minimum

-

Participants want to limit the number of hard inquiries to the last two years.

-

A few participants want soft inquiries moved to their web profile because they don’t impact their credit.

-

Participants want to be clearly educated regarding the impact inquiries have on their credit.

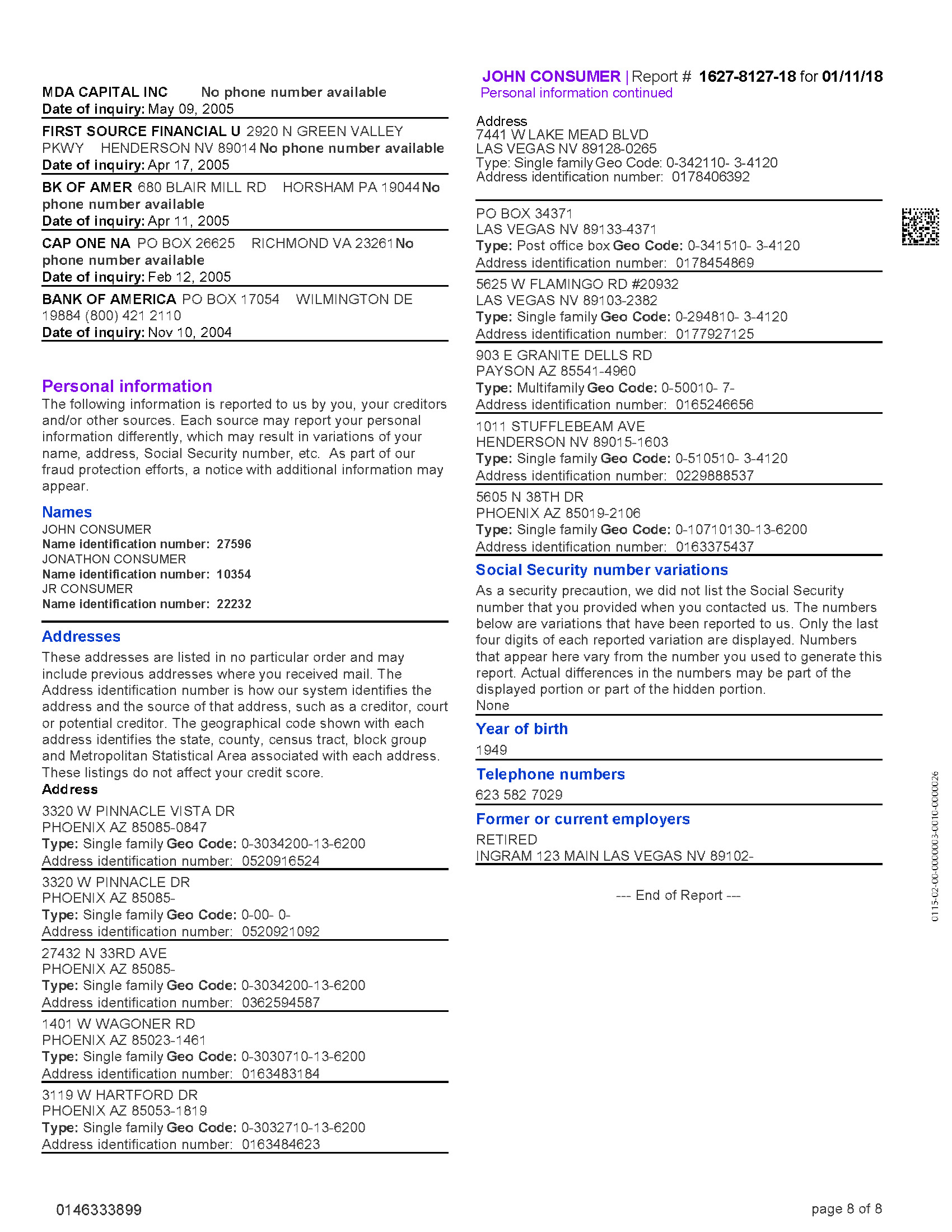

Assessment of the Current Credit Report

As participants reviewed the report many stated that they felt overwhelmed or didn’t want to look at it. The language on the report was not approachable and was difficult to understand. And how the credit report felt like an arduous chore to participants.

”“When there’s too much information on a page, I get lost.”

Donna

”“The language should be at no more than at a

Linda

6th grade reading level.”

”“It’s really hard to understand even what you’re looking for.”

Jason

”“It should be friendly. This is painful.”

Candice

Theme

What We Heard & Observed

I expect to see my credit score.

I want to understand the underlying factors.

Tell me how to improve my credit.

Impactful information is my focus.

Meet my expectations.

Principle

How We Will Address It

We’ll be transparent.

We’ll expose the logic.

We’ll teach you.

We’ll emphasize the big stuff.

We’ll meet you where you are.

Concept A

Concept B

Concept C

Bringing IT All Together

Final Result

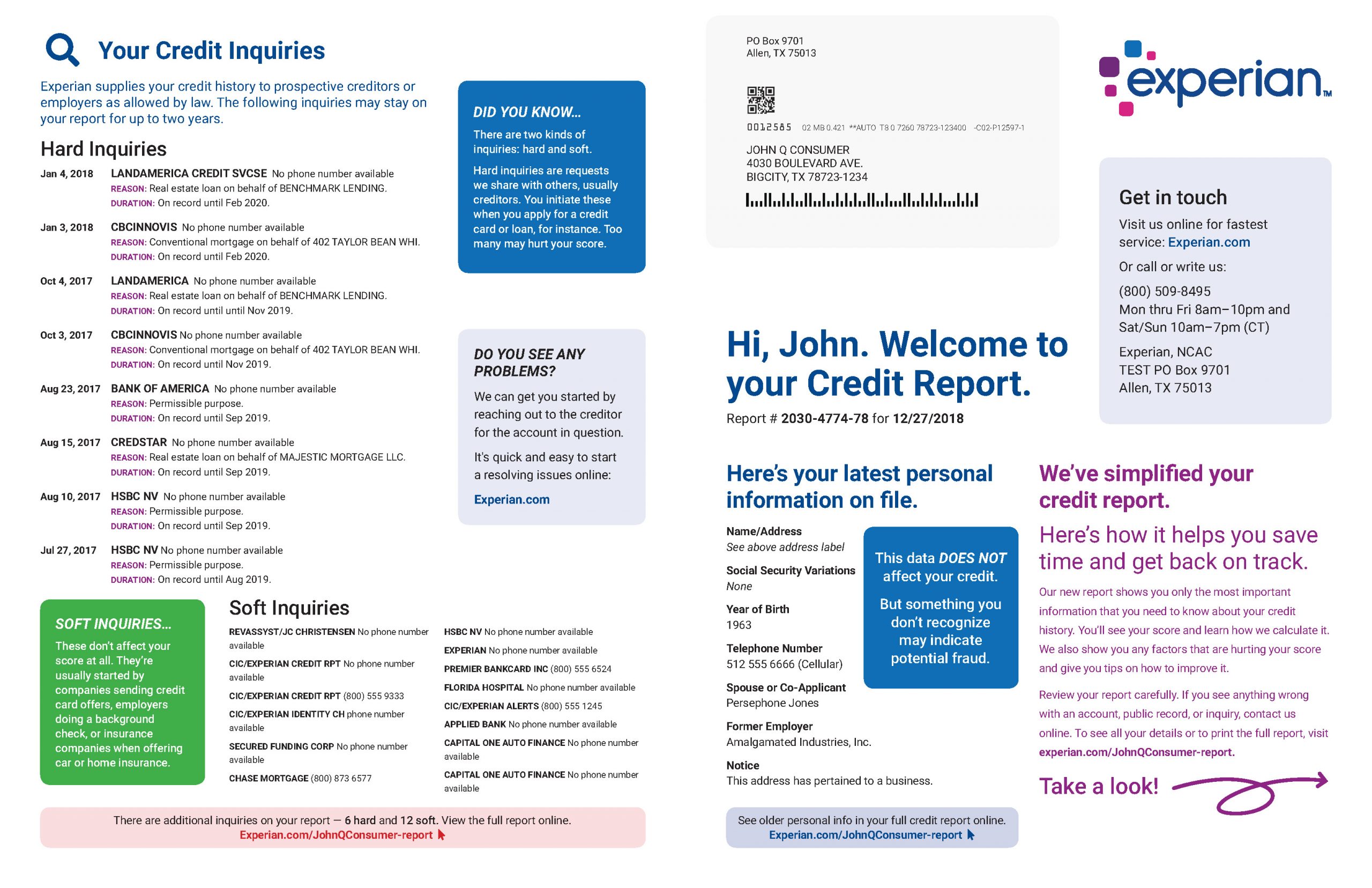

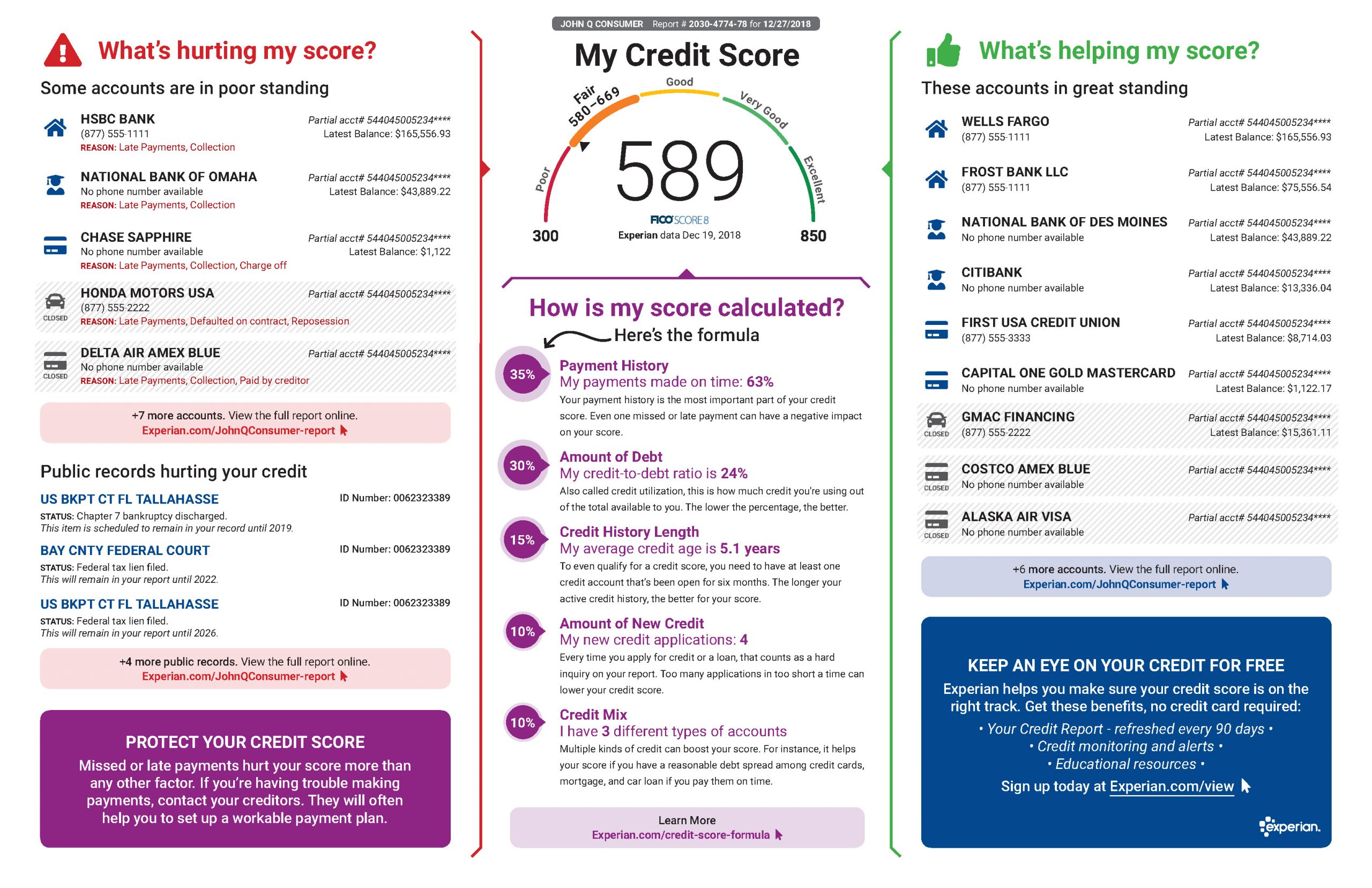

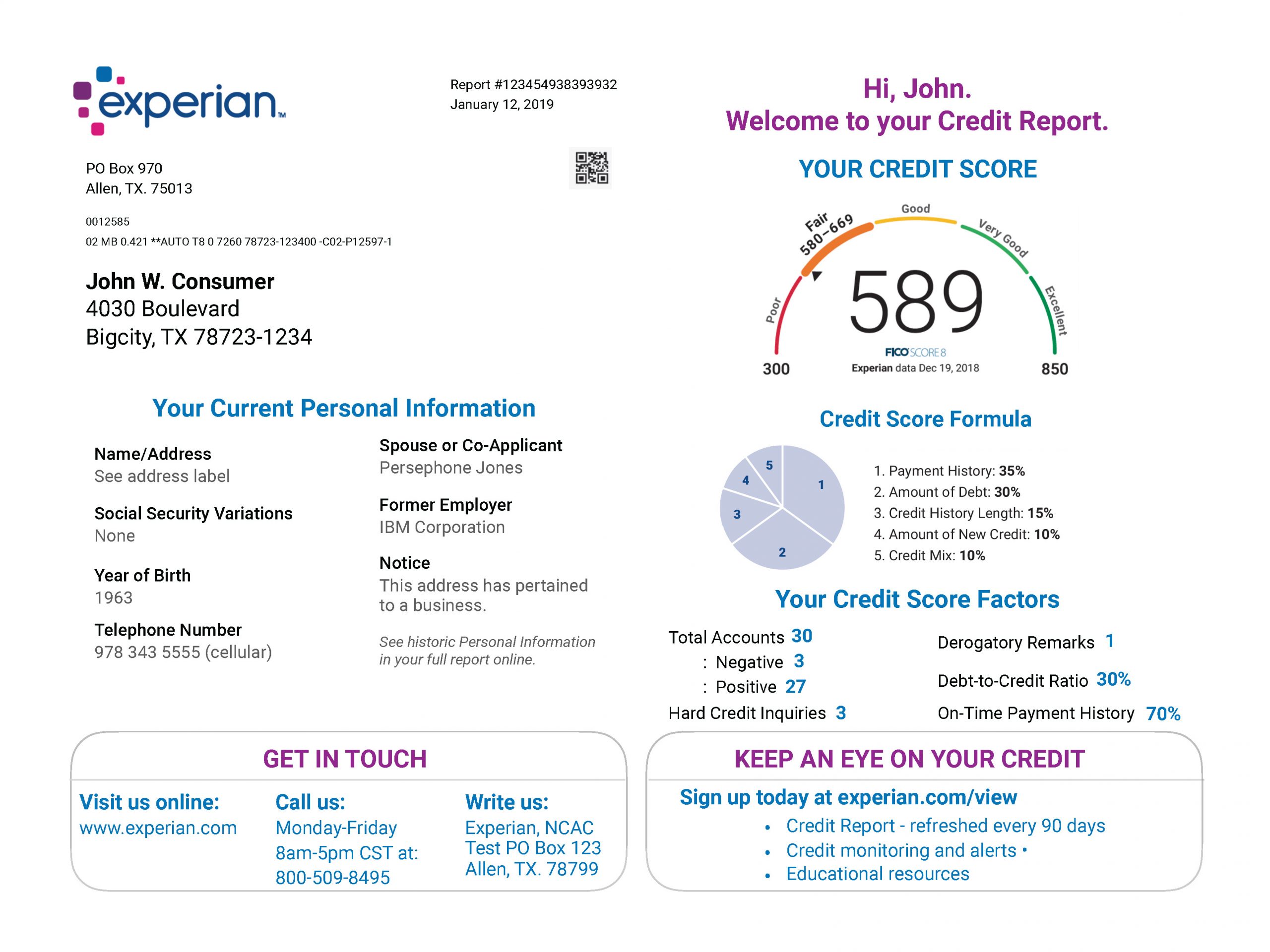

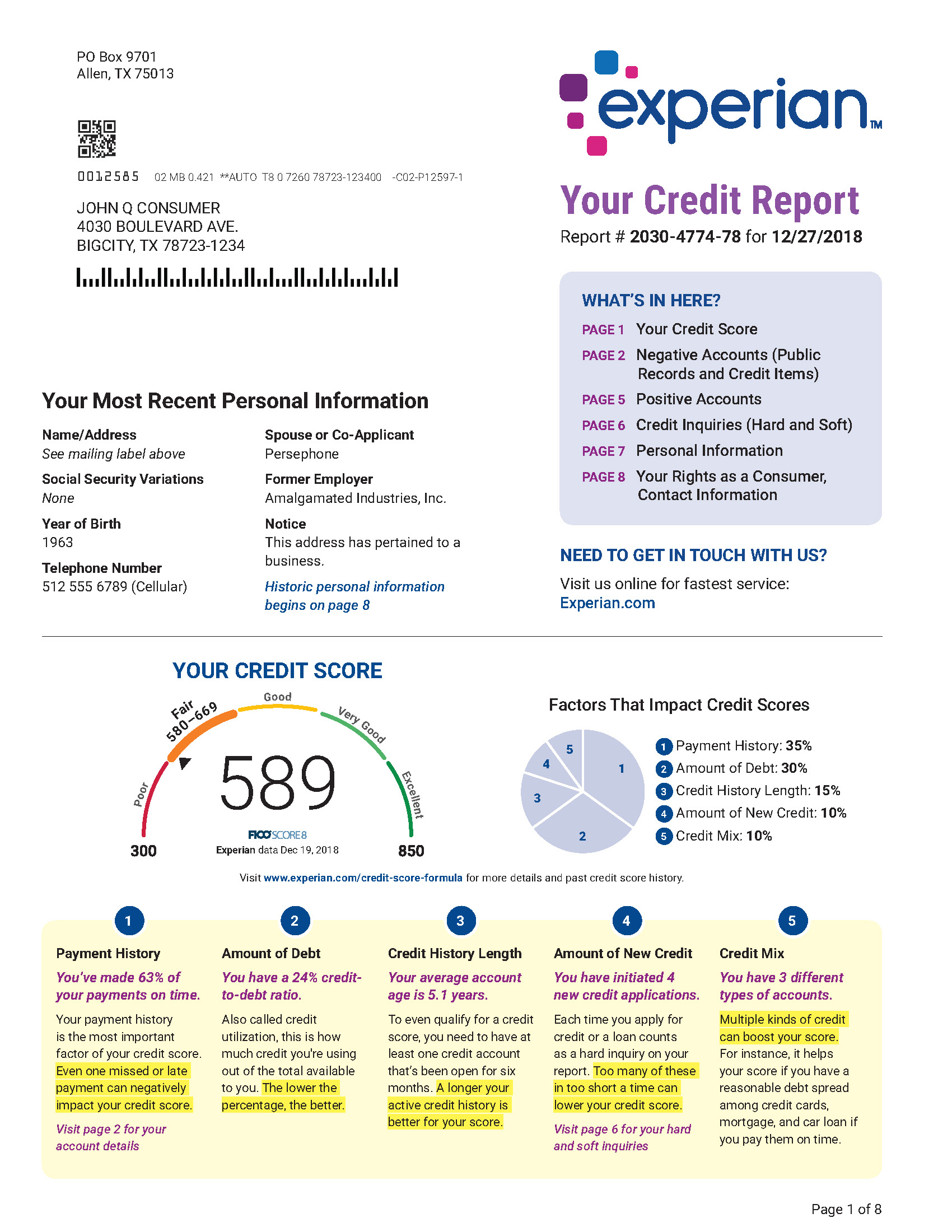

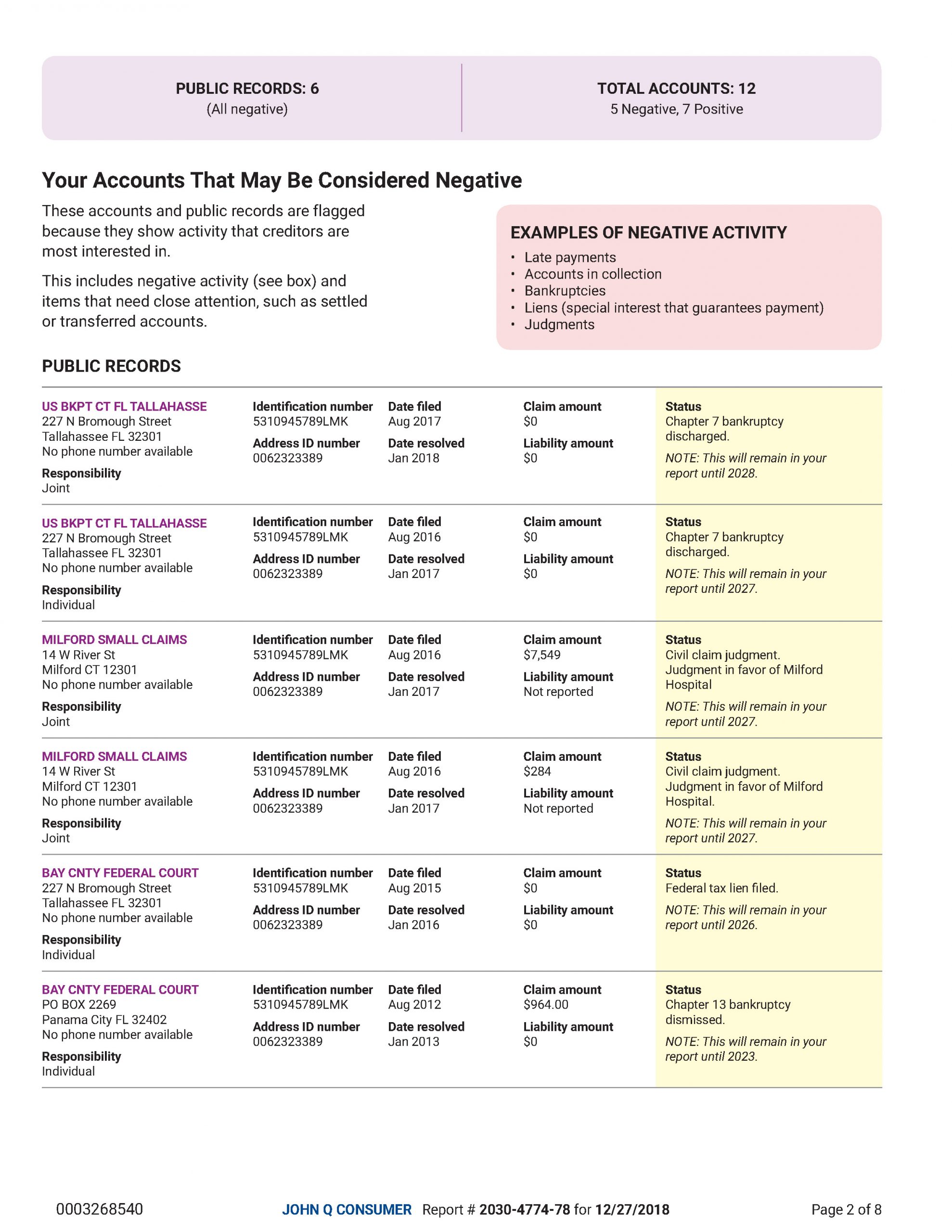

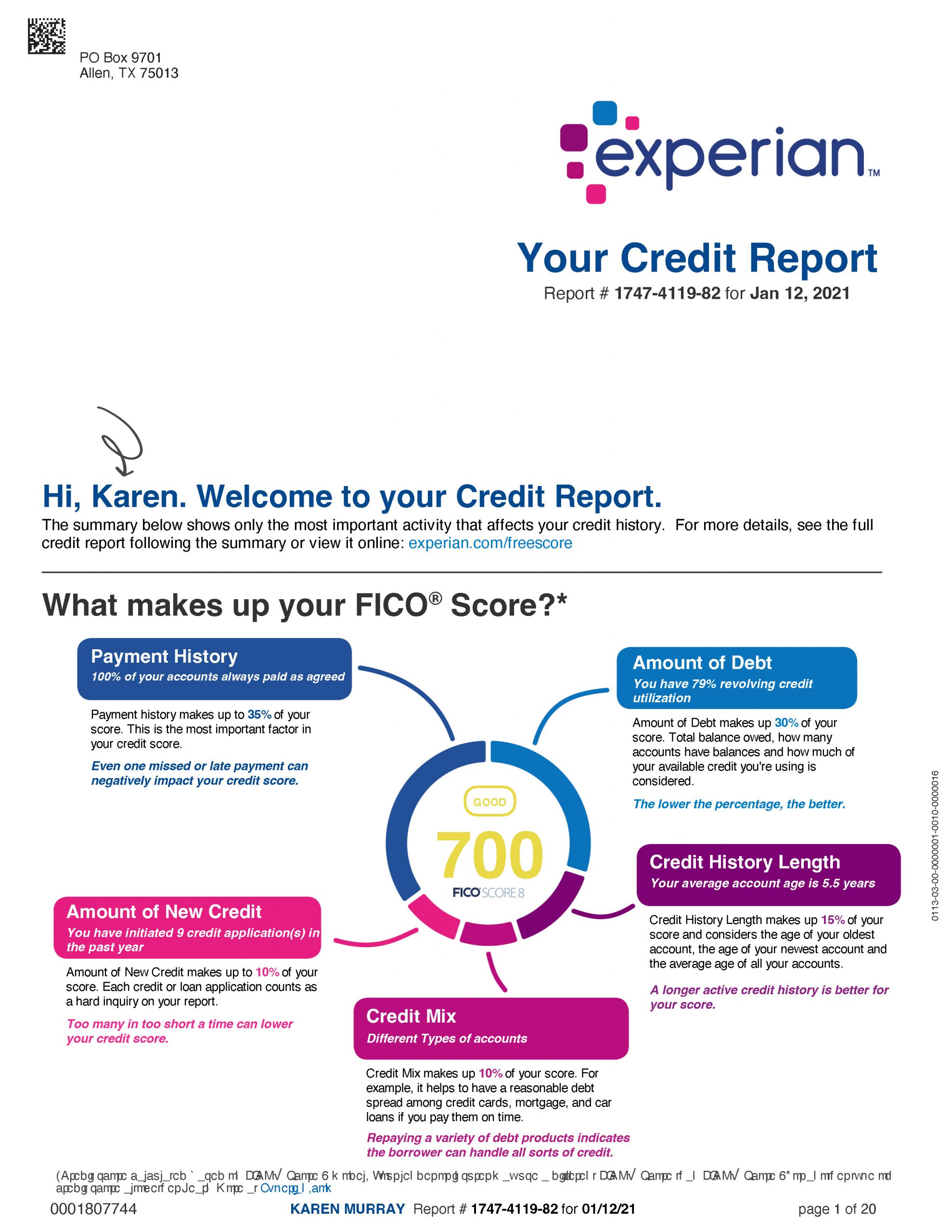

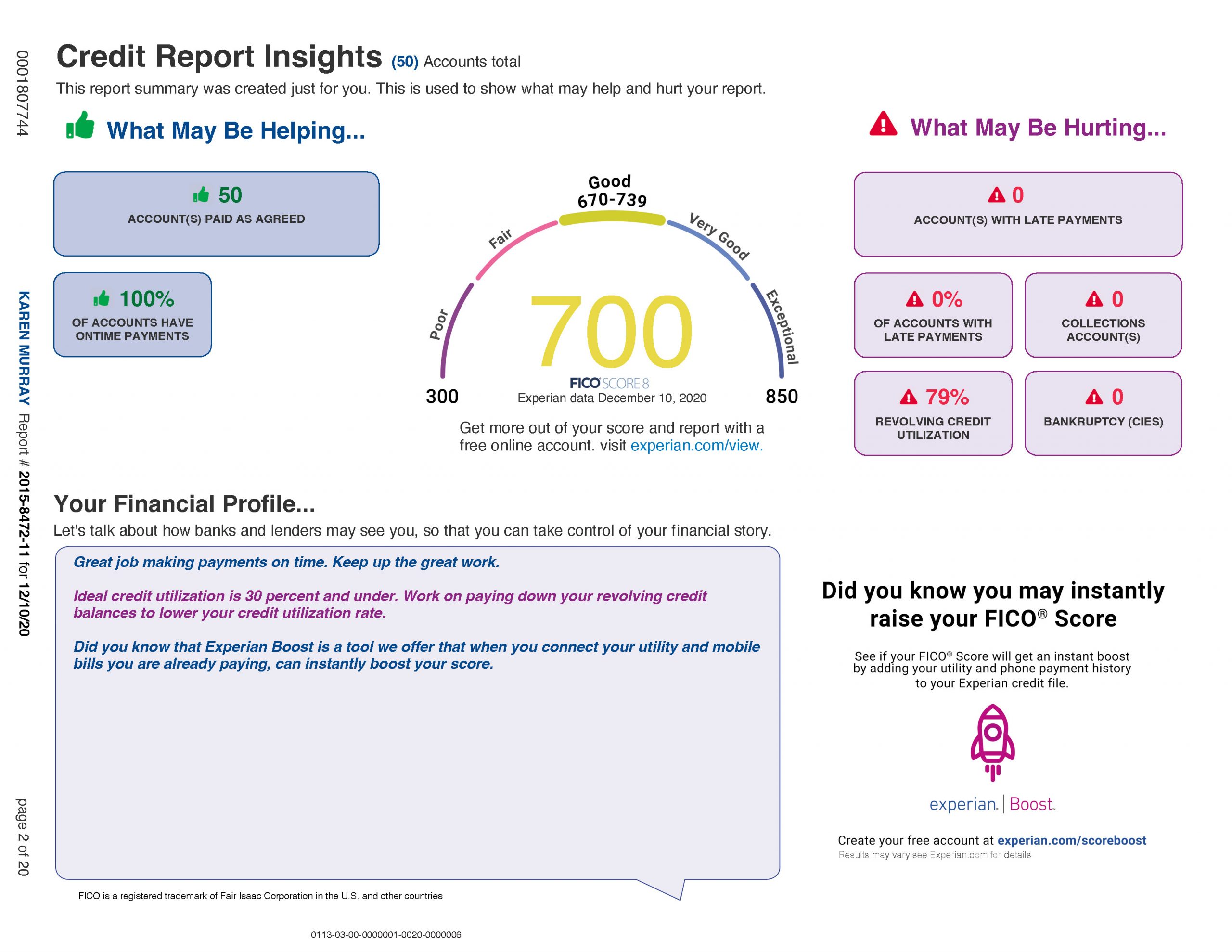

After several iterations and many user testing sessions, the images to the right is the final outcome. Getting the FicoScore 8 on the report was a huge success as well as incorporating real-time dynamic data, education, and a 6-grade reading level.

Project Outcome

1. Beautiful and visually-appealing summation on the first page.

The “gist” of their credit report is highlighted with emphasis on negative areas that need attention. It also contains their credit score and educates them on their personal credit factors behind their credit score.

2. Easy and friendly access to the details.

After their expectations have been set on the first page they are ready to review the details, either on subsequent pages or online.

3. Present the details in a quick and consumable manner.

The detailed credit report should inform and engage clearly and succinctly with a visually-pleasing presentation that utilizes prominent text elements, color, icons and infographics. In a conversational tone, the detailed report should guide and inform consumers employing simplicity and brevity.

4. Give consumers a cohesive report experience: print and online

Consumers have varying preferences regarding how they want to consume the report. Offering both mediums with the same look/feel and content will establish trust and confidence in Experian.